1. PayPal

PayPal is a payment system that makes online transactions as easy as possible. This platform enables you to buy and sell goods through the use of your PayPal account. You can also send and receive money without sharing financial information that can put your identity and private information in harm’s way. By utilizing PayPal as a source of payment, you can purchase items straight from your computer or smartphone. In addition to purchasing items, you can withdraw or send money to other users who also have PayPal accounts. PayPal is easy to set up and only takes a minimum amount of information in order for you to start using the service.

2. Venmo

In today’s world, digital payments are becoming more and more popular. With the emergence of apps like Cash App and PayPal, people are now able to transfer cash with the click of a few buttons. Venmo, in particular, is one of these apps that allow you to transfer money to any other person with a Venmo account. The app is similar to Cash App in that you can connect your bank account or debit card, so you never have to worry about losing money. In addition to this, Venmo doubles as a social media platform, enabling you to share what you are buying or where you are eating with your friends. This app is only available in the United States, but can be used anywhere in the world with a U.S. bank account and credit card.

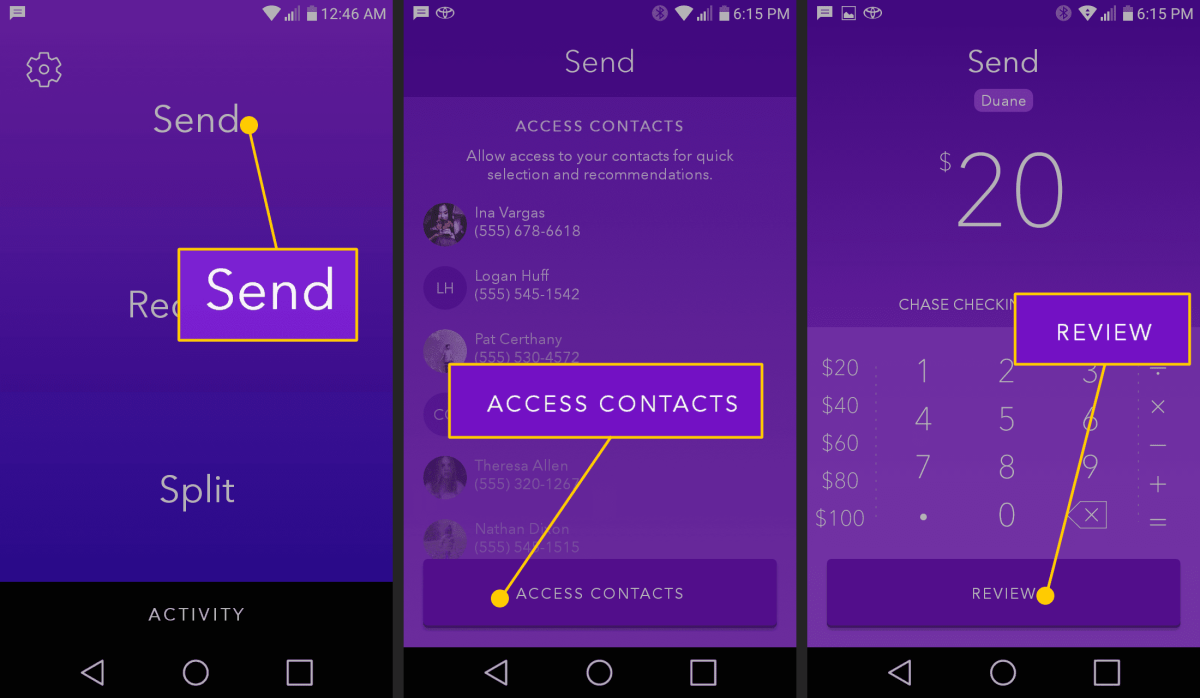

3. Zelle

The Zelle app is an app that allows you to send money to other people in your contact list, and it’s already being used by millions of people across the globe. However, it isn’t just another Venmo or Cash App clone. Zelle comes with specific advantages over these other apps, and here are some of the main ones. One of the biggest problems with Venmo and PayPal is that these apps have experienced hacking issues in the past. This means that your account can be very easily hacked into, and then all of the money in your account might be gone without realizing it. However, Zelle is one of the most secure payment apps out there. All of your personal information is encrypted when sent to and from Zelle, and it uses a system of “skills” to verify all financial information. This means that nobody can take your money from you without being verified by Zelle first. Because Zelle is a lot like Cash App, you can easily access it from any iOS or Android device. All you have to do is go onto the app, type in your name and phone number, and then enter in some other personal information like your date of birth and address. Then, you can send or request money from anybody else who’s on Zelle no matter where they are in the world.

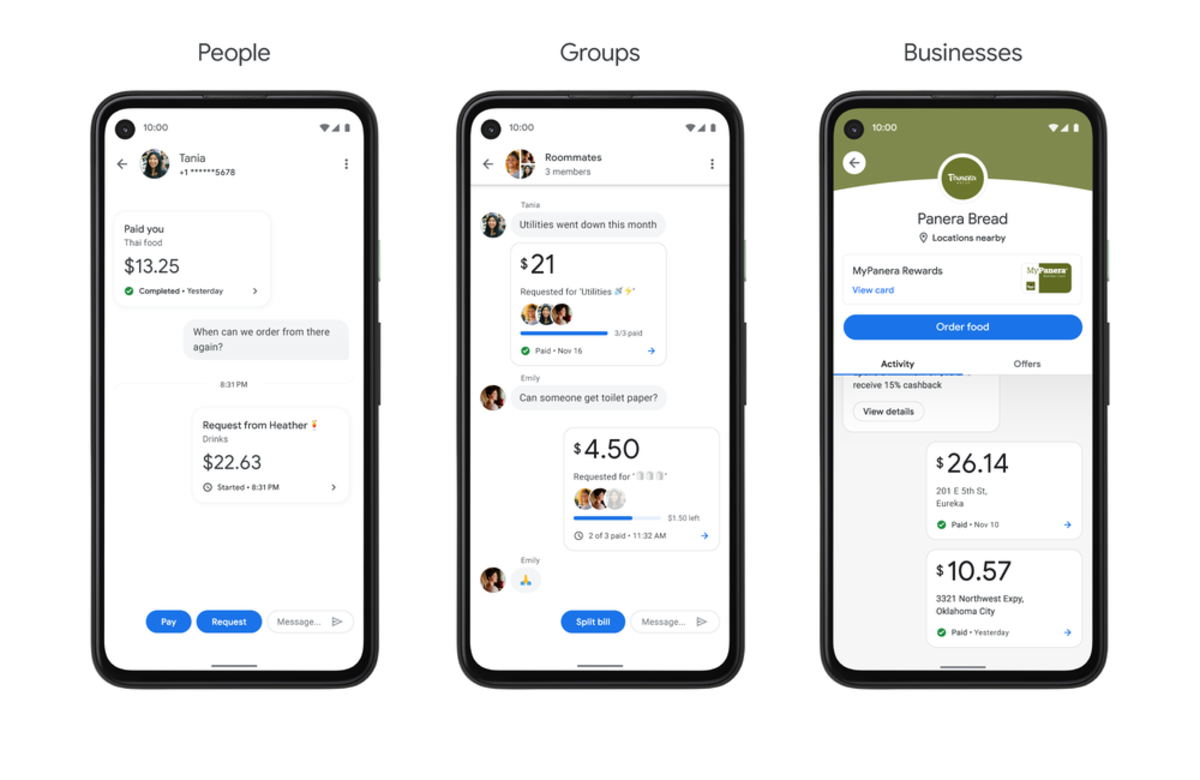

4. Google Pay

The world of mobile payments is getting more and more crowded by the day, but Google Pay (formerly Android Pay) is one that’s hard to pass up. Aside from being compatible with a huge number of devices, what are the benefits of using this payment method? Google Pay is perfect for those who don’t want to fumble around with cash or their wallet while on the go. The app allows users to make mobile payments through “Tap & Pay.” One tap of the phone against a payment terminal, and you’re good to go. You can even save the credit card you use most often so that it’s always available. A fingerprint acts as an extra layer of protection for users who use Google Pay. It can be used instead of a PIN or password, so you don’t have to enter the same security code over and over again. If you’re using an Android phone, you don’t have to worry about losing everything. Google makes it easy to back up all of your payment information to the cloud so that you can restore everything at a moment’s notice.

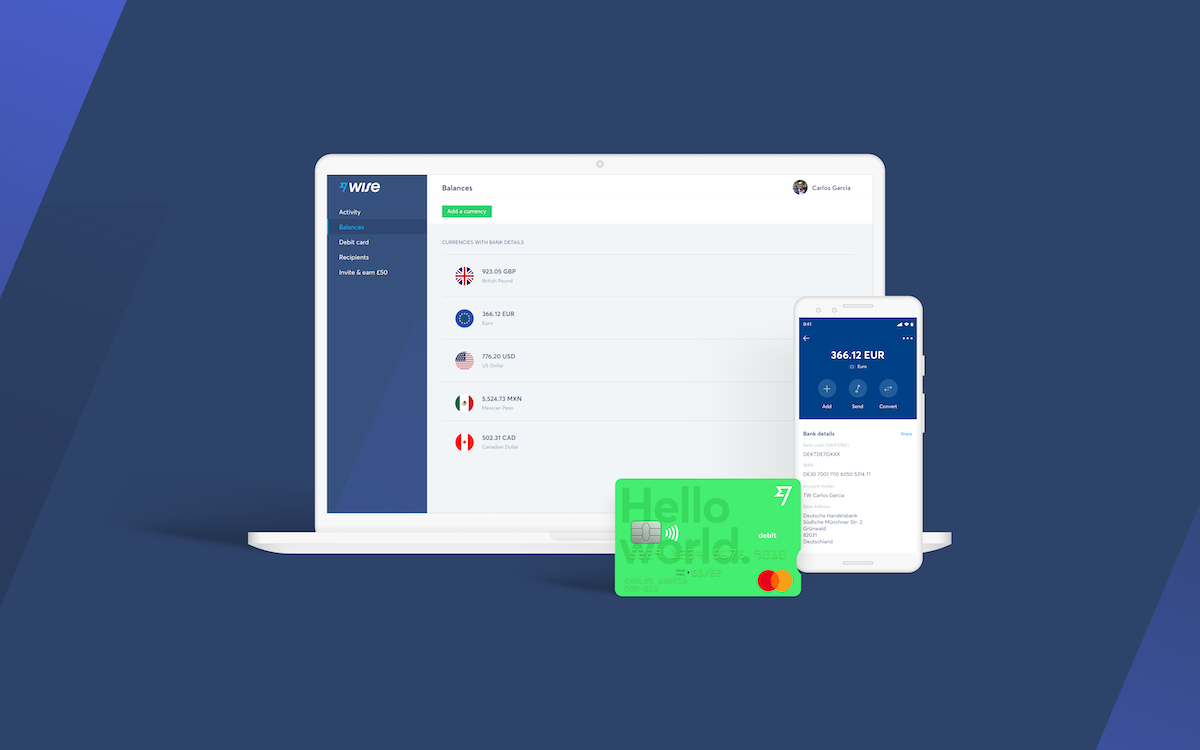

5. Wise

The world has shrunk a lot with modern technology. For example, a company in New York can easily communicate and do business with a company in Paris. But when it comes to transferring funds, that is a different story. It can be very challenging and time-consuming for businesses to send and receive money across the continent, which is why it often takes longer than expected. Wise is an app that can simplify this process because it is designed to make money transfer easier. Even though it is relatively new, some users are already singing its praises. The app uses “social graph technology” to make money transfer smooth and fast. Once a user downloads the app, he or she will be asked for payment information such as bank account and credit card number. After this is submitted, the user will receive a notification via email or text message that he or she has received money. This works regardless of the recipient’s location, so if someone in Paris receives money, he or she would get a notification regardless. In addition, it features an exchange calculator that is able to provide the user with accurate rates, so there are no hidden fees. With this tool, users can compare the rates of different money transfer services and determine which is more financially advantageous.

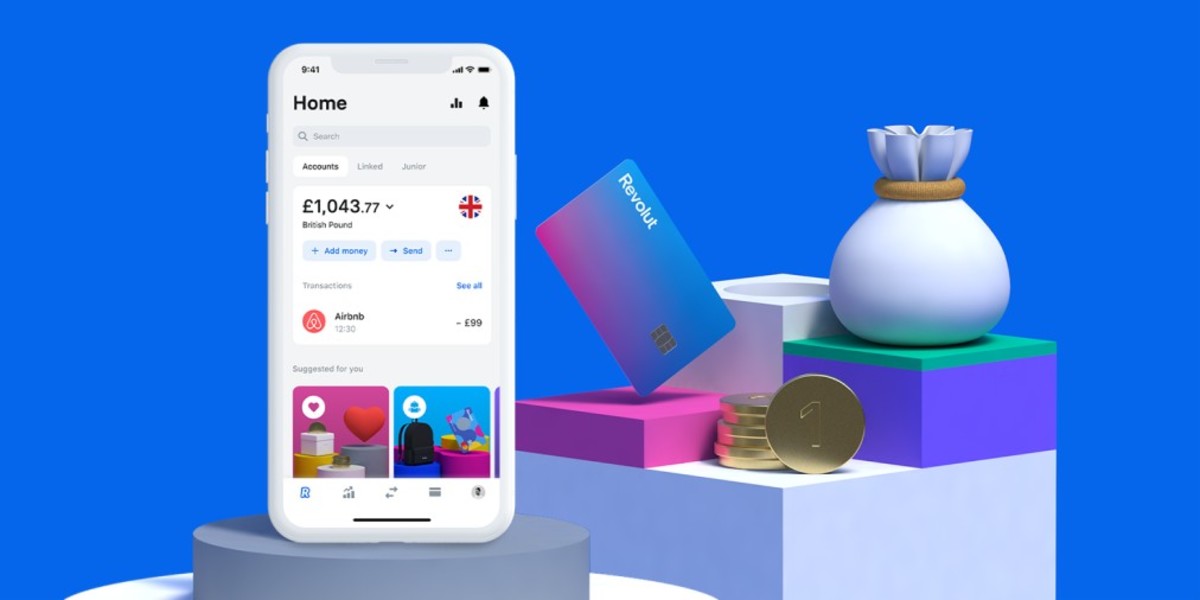

6. Revolut

In a world where you can purchase almost anything online, having access to your bank card information at anytime and anywhere is vital for both convenience and security. For decades, people have been using their credit cards when shopping online. The prevalence of internet shopping has led to the emergence of several digital payment apps that make it possible to shop securely and conveniently. One of these payment apps is Revolut. Established in 2015, the London-based company was created with the intent to give its customers ‘first class’ banking services that are user-friendly and efficient. Revolut offers users a ‘global banking alternative’ by linking users to the MasterCard’s contactless payment network. This has made it possible for Revolut users to purchase goods and services globally. With this app, you know that your money is safe as Revolut complies with strict European rules for finance companies. This means that you have access to the same level of security as for traditional banks. As a Revolut cardholder, you can pay for your purchases without paying any fee as long as your transactions fall below a certain threshold that is determined by your country. You can easily convert money to a different currency, even if the currency is not supported by the app. All you need to do is pick a currency that you wish to convert into and an exchange rate is given. You just need to click on the button and wait for a few seconds to see your money get converted into that currency. There’s an option to create a business account that comes with competitive international and domestic card acceptance fees. This allows small businesses to accept credit card payments without any risk.

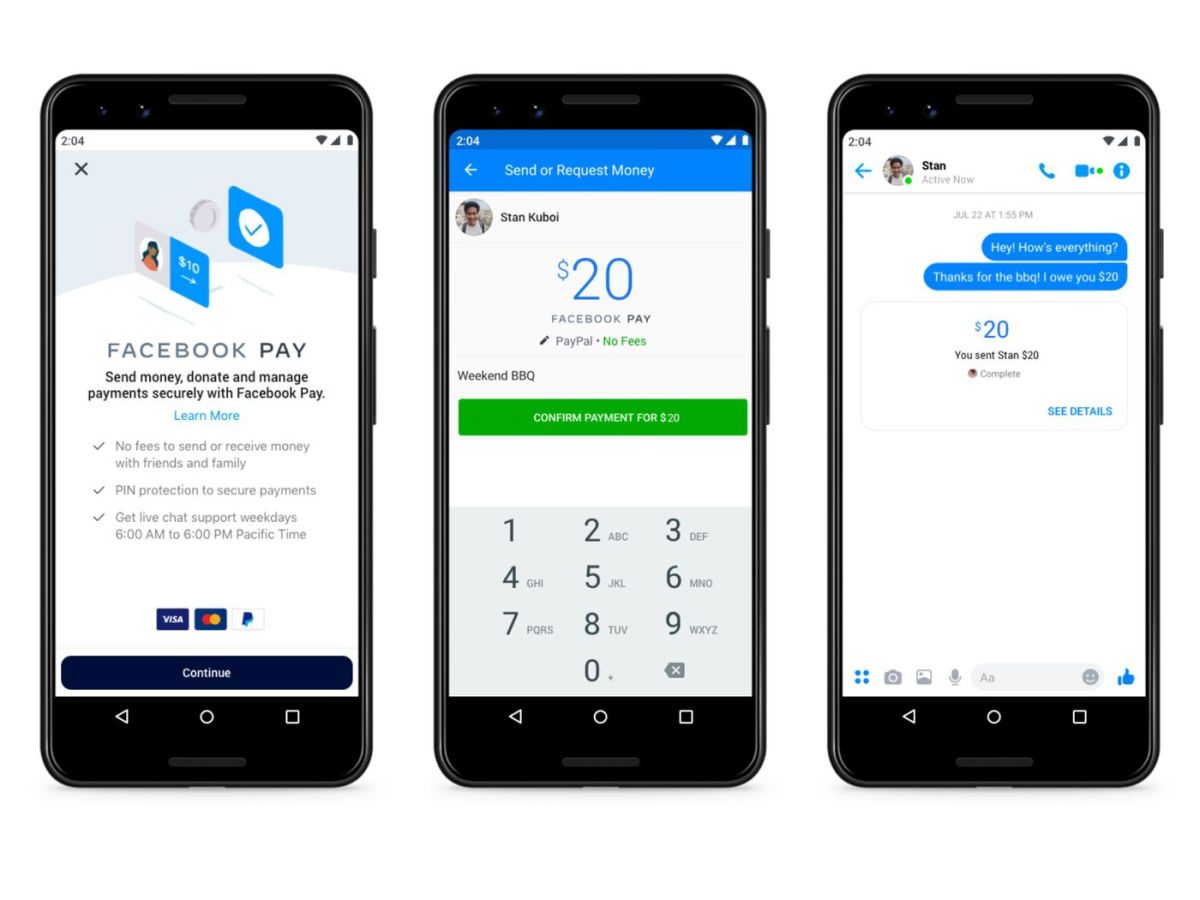

7. Facebook Pay

The rise of mobile commerce is here, and it’s taking the world by storm. The first major player in social media to launch a payment app is Facebook, with its most recent app, Facebook Pay. People are most familiar with the fact that when you purchase something on Facebook you can use a credit card without having to download an app. The Facebook Pay app, however, is a lot more involved and has far more features. It’s a fast and safe way to pay for peers and businesses alike. Facebook is a huge platform with a lot of users. As a result, it’s only natural that they would develop a payment app to make it easier for people to purchase things. This is the main benefit of Facebook Pay. It’s a way for users to pay each other or their favorite businesses via Facebook Messenger. All payments are securely encrypted to guarantee safety for users. Facebook wants to make its users’ payment experience as smooth and secure as possible. Therefore, Facebook users can integrate their credit or debit card to Facebook Pay, allowing them to buy goods or services on the platform. Users will be notified by Facebook through text message of every transaction that is made. As more people are using mobile devices to make purchases, it’s important for businesses to be able to accept mobile payments. Facebook Pay is a payment app that can be used through a business’s Facebook page to accept payments from its customers. Businesses can use this tool to track inventory and revenue as well. Facebook Pay allows businesses to accept payment in-app or on mobile websites. Businesses can customize how they process payments, either within a Facebook app or on a mobile website. The process is simple, and it only requires the business to enter their bank details into Facebook’s system. Once the account is set up, users with Facebook accounts can select to pay on a business’s website or within the Facebook app.

8. Payoneer

Do you want to receive all of your payments in one single account? If the answer is yes, then Payoneer may be the perfect option for you. Payoneer is a payment app that allows you to process online transactions and receive payouts in your Payoneer account. All you need is an e-mail address to sign up for this payment app. The benefits of using Payoneer are that you can receive all of your payments in one place, choose from multiple payout options, and you have access to multiple currency accounts and can also withdraw and deposit money. Payoneer is a company that allows you to receive payments from anywhere in the world. You can compare this service to other payment apps, such as PayPal. However, there are some different features that make Payoneer stand out from the rest. If you have a Payoneer account, then you can send money from your account to another person’s Payoneer account. This is very beneficial if you want to send money to family or friends. The only requirement is that the person needs a Payoneer account as well.

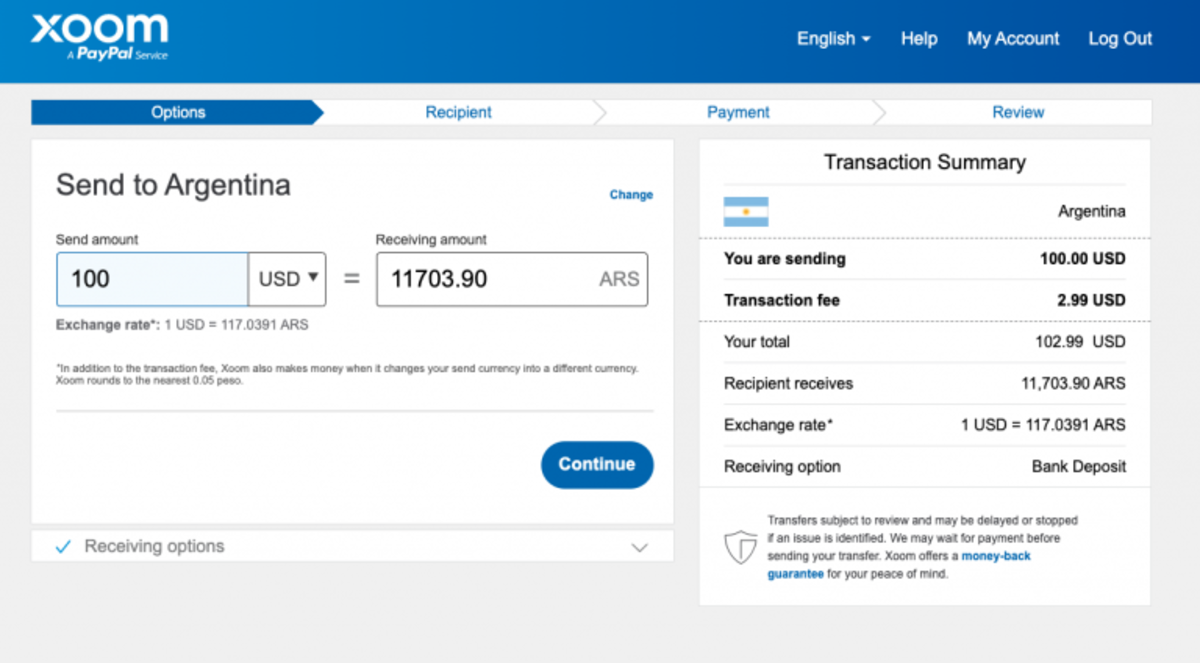

9. Xoom Money Transfer

Xoom, a leading payment app in the US, is proud to offer its services to over 40 million people worldwide. Xoom allows users to send money, remit money, and pay bills online. It is a secure app that offers 24/7 customer support to its customers. Xoom is powered by the same company that started Paypal, a payment app that is widely used for transferring money. This makes Xoom Money Transfer reliable, secure, and an excellent option to send money online. One of its hallmarks is its unparalleled security, enabling you to send money with ease and feel confident knowing that your money and information are safe. All personal and financial information is encrypted and stored securely on Xoom’s servers to ensure that your private information is kept private. You can send money using credit or debit cards, bank accounts, and Paypal. However, if you send money from a bank account, it will take 3 days for the funds to arrive at their destination. You will have to go through a verification process to send money. If you send more than $1,000 in total in one day, you will need to get verified before sending money after that.

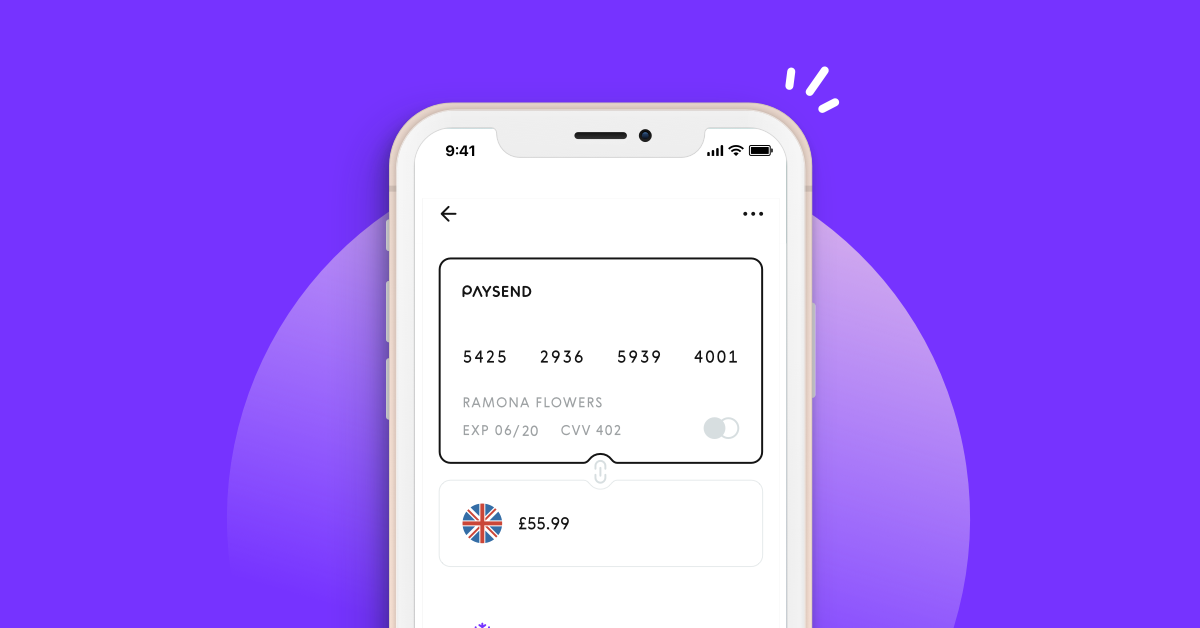

10. Paysend

There are many ways you can send or receive payments. Of course, there’s cash, but also Cash App, PayPal, Venmo and now, there’s Paysend. Paysend is a mobile app that allows you to make transactions directly from your bank accounts, which traditional bank transfers can’t do. Because of this, you are able to avoid the exorbitant fees that banks charge when making international money transfers. Paysend also allows for recipients to pick up cash directly from Paysend retailers in their neighborhood. And when they do use the app, both senders and receivers are given up to 6 percent cash back on their purchases. So, what makes this app better than other mobile transfer apps like Cash App? Paysend is a much better alternative because Cash App charges users $3 when they use it to purchase money orders. Also, when you send money overseas, Cash App charges you $4.50 per transaction versus Paysend’s $1.80. Paysend is free to download. And for those who are worried that Paysend will charge users hidden fees, rest assured—there are no service charges, monthly fees or foreign transaction fees. Paysend is a better alternative to Cash App because it allows users to avoid banks and still receive their money in the most cost-effective manner. This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.